Plus, remember you would not happen a charge for private mortgage insurance with good USDA loan often. Alternatively, it’ll cost you 1% initial payment and will also incur a great 0.35% yearly capital payment.

Why Was The brand new USDA System Created?

Initial, the latest USDA system was designed to increase the life conditions from inside the Outlying The usa so are there specific location conditions that come together that have a beneficial USDA Home loan. According to USDA an area can qualify given that outlying in the event the it has a society less than 20,000, it’s just not contained inside an urban Analytical area, and/or features a lack of home loan borrowing having reasonable so you’re able to reasonable income homebuyers.

You can check out the new USDA website’s qualifications map locate components surrounding you which might be believed rural. All five years the field practices throughout the country will opinion the areas that they are guilty of to make modifications into qualifications map. Therefore utilize when you normally due to the fact next couples decades eligible urban centers you can expect to alter.

Once you know the property is in a qualified venue and you may your be considered considering your revenue, after that your nearer than before so you can good USDA Home loan. Then you need consider when you are ready to result in the assets their long lasting household.

USDA Financial Home Requirements

One of many criteria to possess a beneficial USDA mortgage is the fact that owner consume this new residence. The newest USDA provides that it financial choice so parents can afford discover reasonable and you may safer homes. It is far from an option for borrowers in search of to purchase financing otherwise travel properties.

So can be you happy to relocate? Really does a USDA mortgage attract you? If that’s the case, why don’t we glance at the last eligibility criteria.

USDA Mortgage Constraints

A different sort of limiting grounds the newest USDA need that discover was mortgage limitations. With respect to the city your getting into the new USDA limitations how far you need obtain. The mortgage limit is founded on this new ple, cities in Ca otherwise The state will receive a higher financing maximum than simply elements of outlying The united states.

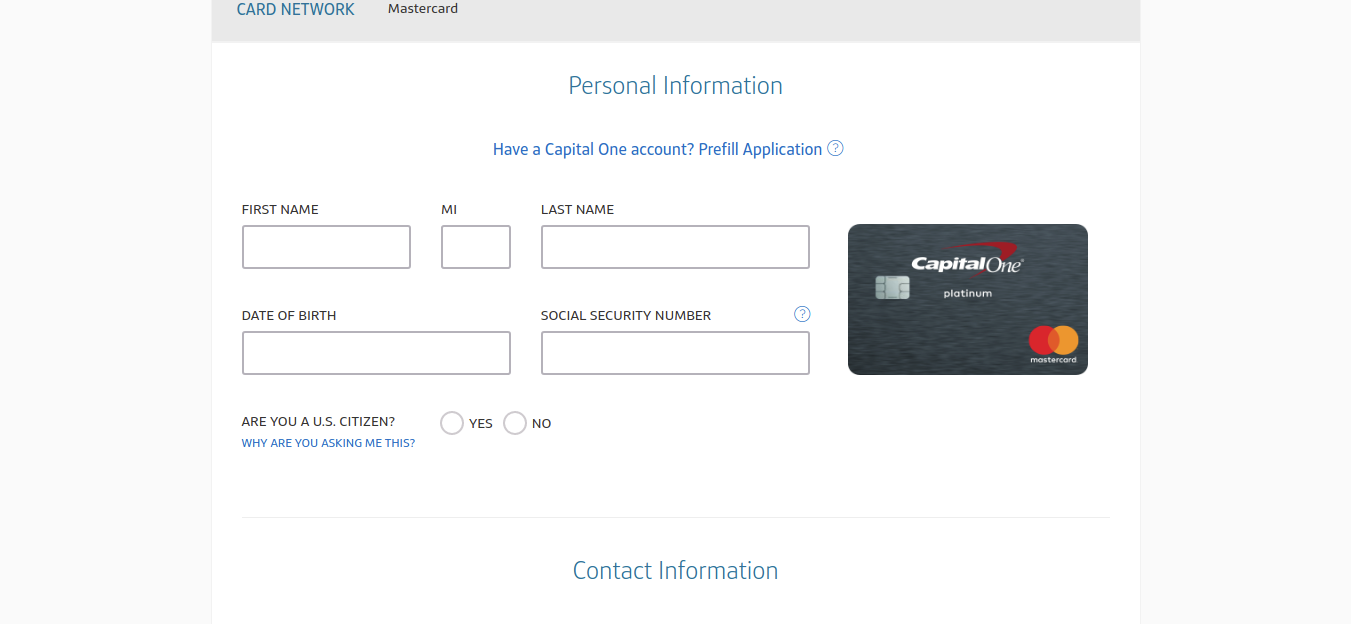

USDA Citizenship Official certification

Ultimately, to help you have fun with an effective USDA Financial, you must be a good U.S. Citizen, non-resident national, otherwise accredited Alien. You must be in a position to inform you https://clickcashadvance.com/personal-loans-ut/kingston an appropriate power to happen the mortgage duty and now have demonstrate that you’ve not started suspended otherwise debarred away from involvement into the government applications.

Anyone who has started outstanding on their government taxes for more than just $step three,000 otherwise have a ticket of Medication-100 % free Office Work was suspended from Government Programsmission of Ripoff otherwise Embezzlement, Thieves, Forgery or an unfair exchange act are also samples of an excellent reason that people could be frozen from applications along these lines one to.

The fresh new USDA wants honest and you may reliable men and women to promote away its money so you’re able to, but it is not truly the only demands. Such all other Federally financed homes system you need to buy mortgage insurance rates along with your financial.

USDA Financial Financial obligation

Immediately after you happen to be willing to lock the USDA home loan it can become time for you to check out the most other loans which come also very funds. Financial insurance is necessary since the every financial desires be able to guard by themselves in case you might be not able to pay the loan. Unless you’re purchasing 20% off, you will not have the ability to end delivering home loan insurance coverage.

There’s two type of Financial Insurance coverage, debtor reduced financial insurance and lender paid off home loan insurance coverage. Both in circumstances youre to acquire mortgage insurance coverage, however, there are lots of secret differences between all of them.

Borrower repaid financial insurance is reduced by borrower. If that appears to be an option you’ll desire prevent than simply you can have the lender buy the borrowed funds insurance coverage, but end up being warned it does cause you to has actually increased speed across the life of your loan.