- Upload elizabeth-send to Gigi O’Brien

- Discover LinkedIn character off Gigi O’Brien

- ” data-up-hook-social-utility-bar=”[socialLinks]” href=”#” data-url-pattern=”” target=”_blank” aria-label=”Facebook” title=”Facebook” rel=”noopener noreferrer”> Myspace

- ” data-up-hook-social-utility-bar=”[socialLinks]” href=”#” data-url-pattern=”” target=”_blank” aria-label=”Twitter” title=”Twitter” rel=”noopener noreferrer”> Fb

- ” data-up-hook-social-utility-bar=”[socialLinks]” href=”#” data-url-pattern=”” target=”_blank” aria-label=”LinkedIn” title=”LinkedIn” rel=”noopener noreferrer”> LinkedIn

- “> Hook up Copied

Because the eurozone cost savings was prediction to expand merely 0.5% more than 2023, and you will 0 installment loan Delaware.6% in 2024, complete bank financing is anticipated to statement smaller growth of 2.1% from inside the 2023, while this is an autumn out-of an effective 14-year a lot of 5% year-on-season development in 2022. Credit quantities commonly slow start to choose, that have growth reaching 2.3% in the 2024, step 3.2% in 2025 and you will step three.3% inside the 2026, offered the Western european Central Lender rates cuts expected when you look at the 2024 materialise. Total, this would slow down the price of house and you will business money and you may improve demand for borrowing.

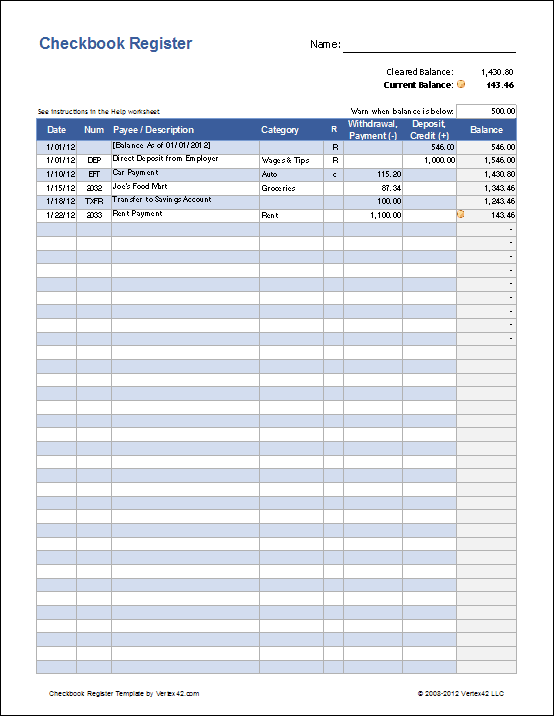

Eurozone financial financing to help you houesholds and you can companies

- Eurozone home loan financing prediction to grow only step 1.5% inside 2023 and you may dos.4% inside 2024 a minimal gains over a-two-year months for the ten years with just quite higher development of step three.3% (net) prediction in 2025

- Demand for credit rating to slow to just one.6% more than 2023 and just grow step one.9% when you look at the 2024, down from dos.7% inside the 2022

- Bank-to-providers credit forecast to expand 2.7% in 2010 in advance of slowing so you’re able to dos.2% in the 2024 that have questioned contractions regarding Italian and you can Spanish segments

- Eurozone low-performing loans to go up just somewhat in 2010, with The country of spain and you may Italy prediction in order to declaration the greatest rates owed to their high quantity of changeable-price mortgage loans

Financial credit over the eurozone is anticipated to list , according to the latest EY Eu Financial Credit Economic Anticipate, once the large credit costs, weakened economic gains and you can shedding housing market belief lower consult. Inside the internet words, mortgages are expected to rise only step 1.5% inside 2023 and you can dos.4% inside the 2024, symbolizing the fresh new slowest development in a decade.

As eurozone discount was forecast to grow only 0.5% more than 2023, and you may 0.6% in 2024, total financial lending is anticipated so you can declaration modest growth of dos.1% into the 2023, although this is a trip off a beneficial fourteen-season a lot of 5% year-on-season growth in 2022. Lending volumes often slower beginning to collect, that have gains getting together with dos.3% inside 2024, step 3.2% during the 2025 and you may step three.3% into the 2026, given this new European Central Lender price incisions asked in 2024 materialise. Overall, this would slow down the price of family and you will business fund and you can improve interest in borrowing from the bank.

Eurozone financial financing to houesholds and providers

\r\n”>>” data-up-is=”rich-text” data-up-translation-read-more=”Find out more” data-up-translation-read-less=”Understand Shorter” data-up-translation-aria-label-read-more=”Read more button, push get into to engage, or take up arrow key to learn more about this article” data-up-translation-aria-label-read-less=”Read reduced button, force enter into to interact, or take-up arrow the answer to discover more about the information” data-up-analytics=”rich-text”>

Impatient, European banks face a managing act to keep strong equilibrium sheets, keep your charges down and you may keep support users. This new progress organizations made to digitalise even with a succession away from financial unexpected situations and sluggish increases commonly sit all of them when you look at the a good stead for longer-label triumph, specifically even as we check out stronger gains off next season.

Financial financing increases so you can slow to reasonable height during the a decade

Mortgage loans account fully for almost half of complete financing in the eurozone, additionally the prediction lag in mortgage increases to at least one.5% for the 2023 and dos.4% for the 2024 is short for the new weakest season with the year increase more than good two-year period during the 10 years, and a-sharp . Refined housing market sentiment (notably for the Germany), large borrowing can cost you and you will went on toning out of lending conditions are pretending to reduce one another consult and you will financial accessibility.