Your credit score try a rating out-of just how most likely youre to repay currency your use. When you yourself have a leading get, you will be said to be a reduced chance since the a debtor. Anything more than 700 is pretty highest — many commonly used rating possibilities include 300 to help you 850.

Your credit score make a difference to your daily life in many ways, there are many suggests a leading credit history could save your money. A number of pros, particularly, can save you several thousand dollars.

Ideal mastercard opportunities

If you’re getting started with borrowing, their credit card options are restricted. The fresh cards you’ll rating would-be white on the masters, and you may need to pay a safety put just to discover a charge card. Most starter playing cards plus lack far to give into the regards to rewards, bonuses, or any other pros.

With high credit rating, the card solutions score best. Credit card companies are interested in getting your organization, and they pull out the finishes making use of their better travelling advantages cards and money back notes. Check out types of bank card features you could rating when you have a leading credit rating:

- Sign-right up bonuses well worth $two hundred or more

- High benefits pricing in your instructions

- An effective 0% intro Annual percentage rate to quit attention charges

- No-cost get and you may travelling protections

For those who have a top credit rating, be sure you take benefit of it.View here to see our very own curated set of an informed borrowing cards and you may discover you to definitely now. There are cards with all of men and women provides towards the checklist above — and more.

Lower interest levels into the funds

A high credit history function you should buy down interest rates whenever borrowing money. However, most people are unaware of how much cash away from a positive change it generates.

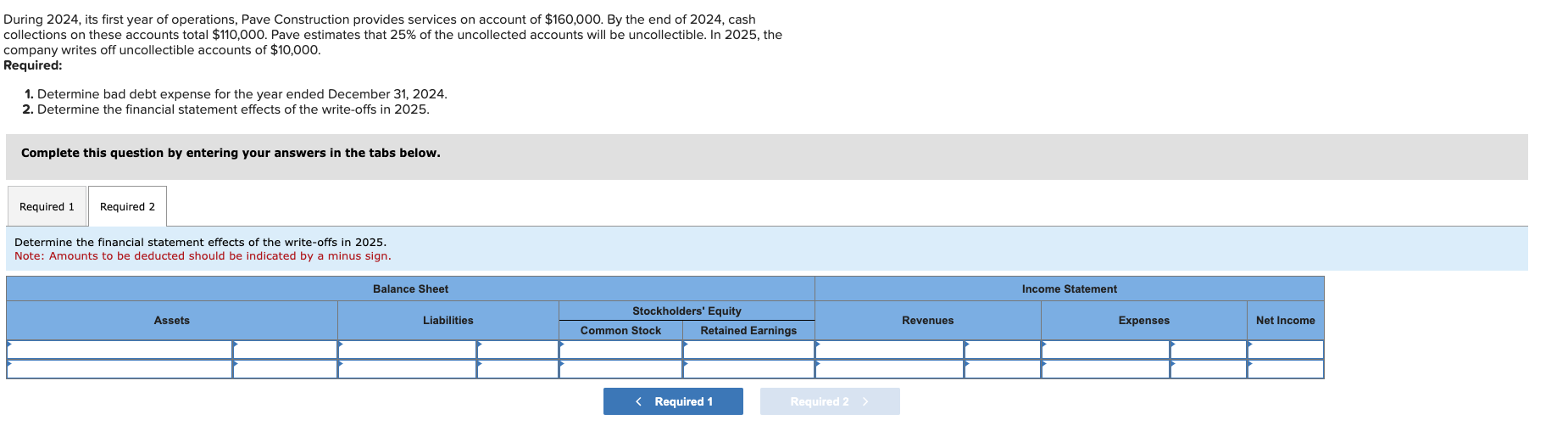

Let’s see probably one of the most well-known style of funds as an example: the latest 29-seasons home loan. Into a thirty-12 months financial for $3 hundred,000, a top credit rating can save you over $50,000. Is a peek at home loan will set you back according to your FICO Get (the quintessential commonly used style of credit rating of the loan providers), centered on analysis regarding MyFICO.

Less auto insurance

In most claims, insurance companies are allowed to make use of your credit history to put your advanced. Vehicle operators with high results score lower rates, while you are vehicle operators which have low ratings is actually punished with additional pricey vehicle insurance. Its a questionable routine, personal loans Chicago bad credit but studies have unearthed that people who have low credit scores file alot more insurance coverage says normally.

We are really not merely talking about a supplementary $5 otherwise $ten monthly, possibly. Drivers with less than perfect credit pay more twice as much to have vehicle insurance because people which have higher level credit. This is actually the average number for each and every group paid for auto insurance during the 2023 therefore the national mediocre, centered on studies achieved by Motley Fool Ascent:

- Federal mediocre: $3,017

- Vehicle operators which have advanced borrowing: $step one,947

- Drivers which have less than perfect credit: $4,145

Many factors go into their car insurance cost. But various other one thing being equivalent, a high credit history might help save you $step 1,000 so you’re able to $dos,000 or higher.

Ways to get a leading credit history

Your credit score will be based upon the track record of borrowing currency. To construct borrowing from the bank, you need to borrow money and you can repay it on time.

Can be done which with either a credit card otherwise financing. Playing cards are usually the greater alternative, since you don’t have to pay attract if you utilize them. For many who spend their card’s full statement harmony per month, you’ll not end up being recharged desire on your own commands.

- Play with a card overseeing provider to keep track of the score.

- Do not overspend on your own handmade cards — keep harmony below 30% of one’s credit limit.

It will take a tiny try to rating a top credit score, nevertheless outcome is worth your while. A good credit score tends to make lifestyle easier, so that as you watched, it can also help you save a fortune.

Alert: high cash back cards we now have viewed is now offering 0% intro

That it mastercard isn’t only a it is so exceptional that our experts use it really. It possess a good 0% introduction Apr to own 15 days, a money back rates all the way to 5%, as well as for some reason for no annual percentage!

We are corporation believers regarding Wonderful Signal, this is why editorial feedback try ours by yourself and have perhaps not become previously reviewed, recognized, or recommended from the incorporated entrepreneurs. The latest Ascent does not defense all the offers in the industry. Article content from the Ascent is actually independent in the Motley Deceive article posts that is developed by a different specialist party.The newest Motley Deceive features a disclosure plan.

Paid back Blog post : Posts produced by Motley Fool. Earth and you can Mail wasn’t on it, and you can material wasn’t analyzed ahead of publication.