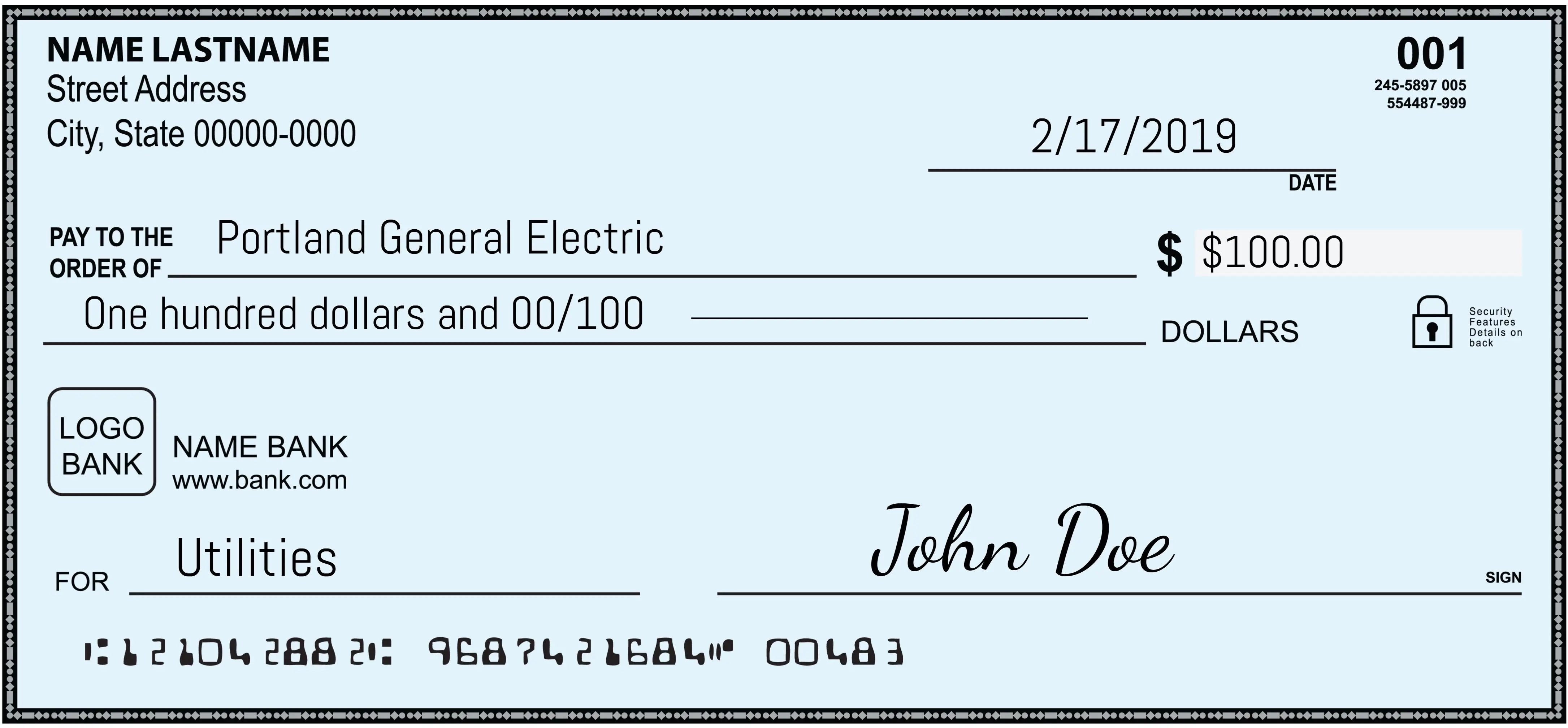

Yes. One of several data files and is offered to your in the closure ‘s the form getting registering for automatic money. This type wants details about the new checking otherwise checking account that you want your monthly payments getting automatically taken of plus a nullified empty take a look at otherwise savings account deposit slip. You’ll found a confirmation page once you’ve already been properly signed up for https://availableloan.net/installment-loans-md/ brand new automated payment program. You can like to subscribe or terminate automatic repayments in the any time.

- Qualification

- Dictate Collateral

- Credit Standards

Consult with a Private Lenders to obtain an initial idea of your qualification, or initiate the application online here. Below are a few things i see: – Credit history with a minimum of 680 – History of in charge borrowing fool around with – Proven a position and you will income – Debt-to-earnings ratio (DTI) lower than 43%

How much cash must i be able to acquire due to a house security mortgage or financial refinance?

Everybody’s finances varies; you should know what you can conveniently afford to acquire. Generally speaking, the mortgage matter you really can afford hinges on four facts:

- Your debt-to-earnings ratio, which is the total monthly payment since the a share of one’s terrible monthly money

- The total amount you are happy to pay for settlement costs

- Your credit history

To possess a much better understanding of how much you can afford to help you use, utilize the price & payment calculator regarding Come across.

How to determine how much money I shall you need?

It can rely on what you are trying to loans. If you are considering a property improve endeavor, look work if in case required rating rates out-of you are able to builders. If you’re considering a debt consolidation, you can consider current asking statements to learn the quantity of any outstanding balances and just what interest rates youre already investing. Many people additionally use loans to cover biggest expenses particularly a marriage otherwise an automible pick. Studies are a large let right here also, but make certain you make sure to imagine every aspect which will get influence your final bill.

In the end, you can consider utilizing your property financing proceeds having several aim. Like you should use home financing to invest in a good do it yourself and you will consolidate your debts. Do your homework and make certain you know how your monthly money often match affordable.

What otherwise should i believe whenever obtaining that loan resistant to the equity in my home?

- Desire on the a house collateral financing is generally tax deductible for renovations less than specific things. Excite consult with your tax mentor to find out if you meet the requirements.

- By using your home since the security you can aquire a decreased rates, although not, if you default on the loan the lender could have the new directly to foreclose on your property.

What types of attributes can be used given that equity for an excellent family guarantee financing or mortgage refinance off Find?

You could potentially submit an application for a home loan from Find using an effective family you possess and you can live in as your priily house. Eligible possessions products become single-family members belongings, condominiums, townhomes, and Prepared Unit Improvements (PUDs). Almost every other functions, eg capital characteristics, are created property, industrial qualities, diary land, trusts, and you can properties bigger than 20 acres are not eligible at this go out.

Exactly how much can you discover due to cash-out refinance?

Usually, lenders will use your own Mutual Financing-to-Well worth (CLTV) proportion to understand your ability to look at brand new loans. Generate your CLTV your self, follow these strategies: