Finance from Relatives sites for loan in Odenville Alabama and buddies: The original port off call for borrowing currency to have startups are friends and family. Over the years, promissory notes features acted while the a type of directly awarded currency. Each goes back to the latest ancient Chinese dynasties and you may were introduced so you can Europe by Marco Polo.

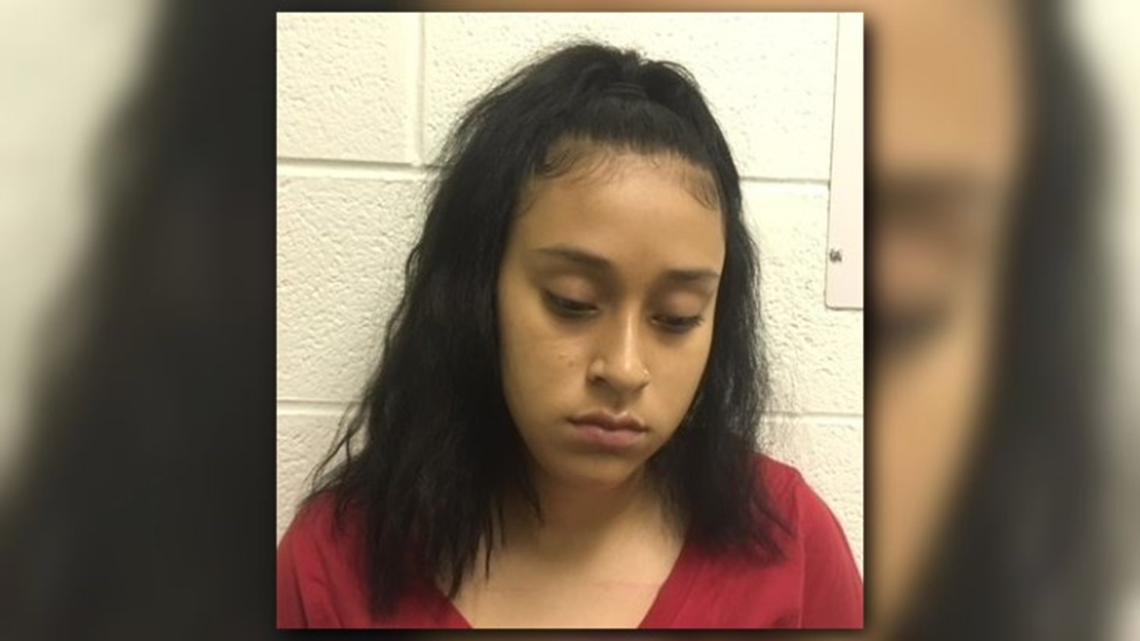

The picture on the right are out of a great promissory note from the second Bank of your United states into the 1840. They’re not therefore quite any further and certainly will getting just typed files, correctly finalized amongst the people.

Financing out of relatives and buddies is actually undoubtedly the greatest amount away from startup loans after the founder’s very own funding or unsecured loans. You to study put the proportion on 38% of all of the startup resource. Whichever the fresh new proportion try, its indeed extremely significant.

Promissory Cards to have Funds regarding Family and friends

When you find yourself relationship is sufficient to obtain the help, the true deal off loans out-of relatives and buddies have to be done properly, or else you will just compromise the firm, but worse, you will undermine men and women matchmaking. If you do acquire out-of friends, then your process is pretty simple. Attempt to draw up good promissory mention to create it off when you look at the a legally binding means for both sides. The mortgage should be safeguarded (against a secured item) otherwise unsecured.

Loans from Friends-Checklist

- brand new functions with the financing, the quantity and interest rate;

- terms of repayment-periodic: regular amounts over the term in addition to financing and focus; balloon: normal degrees of less proportions having a massive terminal payment; lump sum: all the financing and you can notice from the identity;

- one charges for later money and exactly how he or she is in order to become treated;

- where as well as how costs are to be generated;

- penalties (or otherwise not) to have early payment;

- what the results are in the example of standard to the financing;

- shared and some accountability;

- amendment process (in the event the agreed or not);

- transferability of your mortgage;

Totally free Promissory Note Templates

Like otherwise personalize a good promissory observe that suits you and you may if you have the slight hesitance throughout the signing, work on they by your attorneys. Talk about the criterion into the each party for your finance out of family unit members and you may loved ones, before you agree to proceed. You can get 100 % free layouts from:

Having a startup you may prefer a modifiable promissory cards to possess fund away from friends. They can be attractive to folks who are not personal professionals of your friends or maybe more family relations regarding family relations than just your pals. Such loan providers may want to provides the opportunity to take part in the fresh upside of your own brand new strategy. The newest convertible promissory cards are convertible toward equity from the an after date, based upon triggers such as for example type of degrees of funds or cash being attained.

To compensate this type of much more fingers length people into risk they was delivering, the brand new cards offered usually are convertible for a cheap price towards price of the second prominent security bullet and will also consist of good cap’ otherwise an optimum transformation rate-on the rate of which the new mention usually later on transfer.

Modifiable cards are sometimes liked by both advertisers and you may traders, because it is so difficult to put an esteem about what is known as good pre-currency (in advance of additional capital and/or before trading has revealed a credibility)

Crowdfunding-an alternative to Funds away from Relatives and buddies

There are more pathways to help you resource a business except that fund regarding family and friends. They really want a bit more than simply and work out calls. The most famous is to use crowdfunding, often having fun with rewards otherwise security crowdfunding. Perks crowdfunding pertains to your during the a countless selling work and you can choosing what type of prize you can bring.

Collateral crowdfunding is really various other, while requesting funds family and friends (and maybe some individuals you do not discover actually) while making an investment, instead of providing something special (advantages crowdfunding), or and work out a loan that has to be paid, whether or not it concerns paying rates of interest or perhaps not. You will find discussing security crowdfunding and you can brought an initial index from guarantee crowdfunding networks. Hunt.