Quick Situations

Because just one mother, it is possible to qualify for $0 monthly payments within the most recent Cut Plan, even if you enjoys Moms and dad Including loans.

The forgiveness choices are during the invention that may give save, particularly when you have been repaying funds for a long time.

Analysis

Single moms, let us start with your situation: There aren’t any specific education http://paydayloansconnecticut.com/rock-ridge loan forgiveness applications otherwise has tailored for only solitary moms and dads. But do not simply click away yet discover however great news.

While it is perhaps not the fresh immediate forgiveness you could potentially hope for, such options been employed by for many single mothers when you look at the points merely including your very own. They are able to provide actual save and a clear path send.

Our mission will be to assist you in finding an educated way to take control of your money and you may secure a better economic upcoming for your requirements and your people. Let us start off.

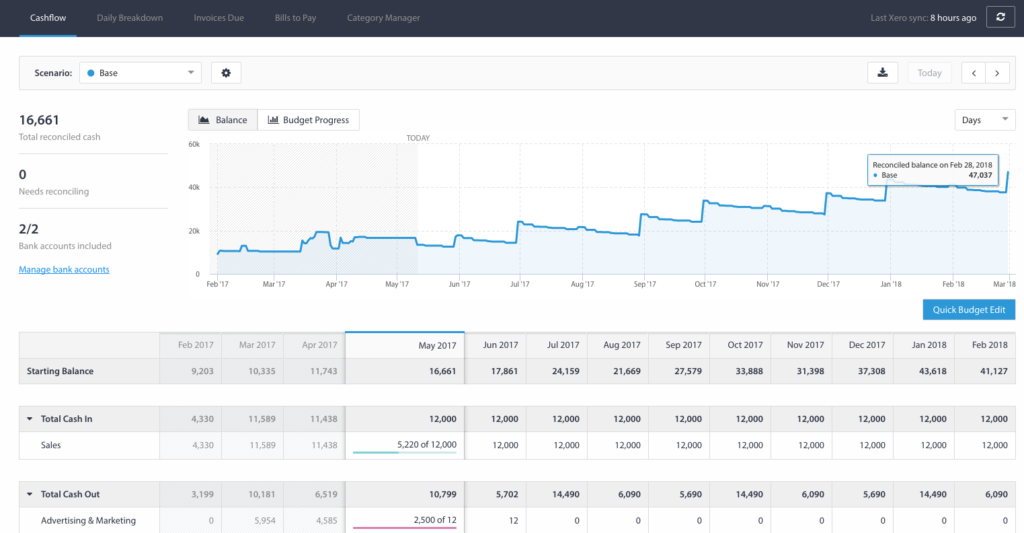

Save your self Plan Forgiveness

The newest Save Package could well be the solution so you can substantially all the way down student mortgage money perhaps even $0 monthly. While you are juggling mortgage money that have child care costs, housing, and all sorts of others expenses regarding elevating students yourself, this plan is designed to you in mind.

What it is: The Save Plan is the latest and more than generous earnings-driven installment option offered. It is made to build your monthly payments cheaper predicated on your revenue and loved ones size.

Which qualifies: You are eligible when you yourself have federal Head Money. This includes finance your took for your own personal knowledge and you will Parent Together with fund for people who consolidate them (more about this after).

All the way down money: The plan spends 225% of one’s impoverishment line so you’re able to estimate discretionary money, definition more of your revenue try secure.

Interest work with: If your percentage doesn’t defense accrued appeal, the us government will cover the real difference, preventing your debts out of growing.

Ideas on how to incorporate: You might make an application for the fresh new Help save Package during your loan servicer or within . You will have to promote facts about your revenue and members of the family proportions.

Note: Although some elements of new Save your self Plan are towards hold because of courtroom challenges, the fresh new key positives, for instance the prospect of $0 repayments, will still be offered. The latest U.S. Institution out of Studies was working to implement even more professionals, which can make this tactic more useful having unmarried moms and dads down the road.

Second actions: While enduring your current costs, envision making an application for new Help save Package immediately. It might rather lower your month-to-month weight, providing you a lot more economic respiration room to look after the ones you love.

Public-service Mortgage Forgiveness

For those who work complete-time for government entities or nonprofit business, you can get you government college loans forgiven shortly after ten years of fabricating student loan payments.

What it is: The latest PSLF System forgives their left federal education loan balance immediately following you will be making 120 qualifying monthly payments (ten years) if you are operating complete-returning to an eligible workplace.

The latest IDR Membership Changes: If you consolidated prior to , you may get credit to have past symptoms out-of fees, even though you weren’t on a being qualified package before.

Next procedures: For people who are employed in public-service, you should never waiting to start your PSLF excursion. All the qualifying commission will get your closer to forgiveness. Though you are not yes you qualify, its really worth checking recent change have made more solitary mom eligible for it system.

Long-Term Forgiveness Options for Single Mothers

If you are Rescue and you will PSLF are common forgiveness alternatives, solitary parents ought to be alert to most other Money-Motivated Installment (IDR) arrangements offering forgiveness shortly after 20 so you can twenty five years regarding repayments. Such agreements are critical for people that never be eligible for PSLF otherwise are influenced by new Save yourself plan keep.