Bluenest couples having creditors and then we can assist for individuals who need an IPA. Simply e mail us at the 3138-2554 or e mail us right here.

Step three. Home Browse!

Based on the within the-concept approval from the financial otherwise HFE Letter from HDB, you’ll know how much you are entitled to use. Nonetheless, you’ll be able to desire to think concerning your financial predicament prior to making a deal.

- Upon searching new IPA, homebuyers possess around thirty day period to pay the option to Pick (OTP) till the IPA ends. The fresh OTP is actually an appropriate file you to definitely has you the proper to purchase the house or property contained in this a specified several months. Afterwards, the OTP holds true to own 21 days to have homebuyers to make relevant downpayment and obtain recognition into well-known bank loan when deciding to take impact.

- This new HFE page is valid for six months about time of procedure. If for example the HFE letter are expiring within this 31 calendar weeks, you can get a one if you are intending purchasing a flat. When you’re taking a financial loan, perform obtain Page of Bring to verify the fresh housing loan. You can move on to take action the latest OTP, fill out resale flat app online and lastly, sit-in the conclusion appointment.

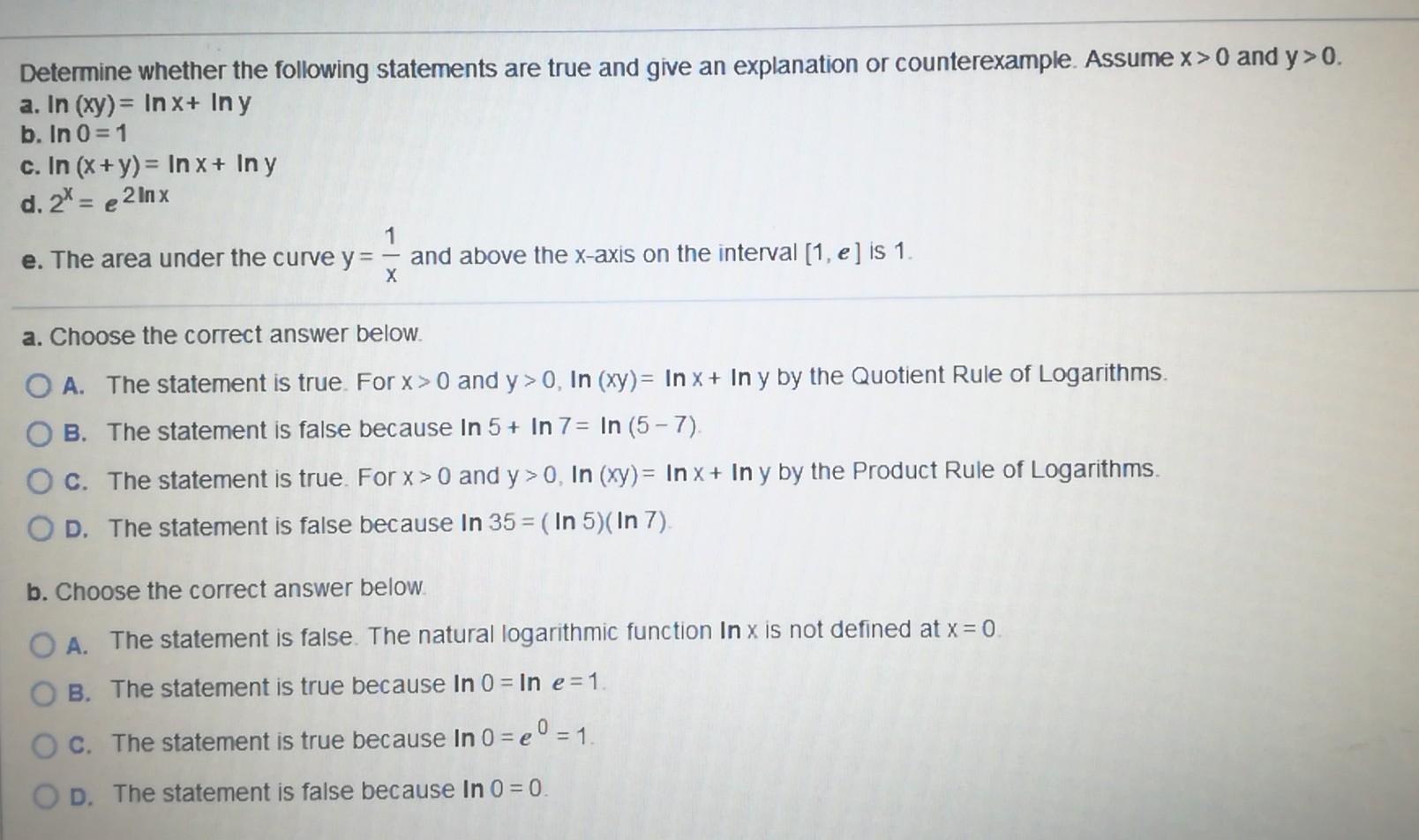

Another type of secret thought when deciding on their housing loan selection is the rates

Choosing the right casing financing rates was a significant domestic. With several banks and you may financing packages available, you should think certain things to generate an educated selection. Below are key considerations when choosing a knowledgeable houses loan appeal prices to meet your needs.

step 1. Do i need to get a predetermined Interest or Floating Interest rate? One of the primary decisions while making is whether to decide having a fixed interest or a drifting interest rate:

i. Repaired Rate of interest: Having a predetermined interest rate, the speed remains unchanged throughout a specific months, usually anywhere between a few so you can five years. This also provides balances and you may predictability in month-to-month mortgage repayments, safeguarding you against markets action.

ii. Drifting Rate of interest: A drifting interest, also known as a varying interest, is also vary predicated on sector requirements. Floating rates houses loan can be labelled towards the Singapore Right away Price Average (SORA) otherwise a predetermined Put Created Rate (FDR). Floating cost give you the possibility of straight down interest levels throughout episodes regarding business refuse however, feature the risk of increased rates if the industry rises.

- Would it be critical for you to have the guarantee regarding consistent monthly installments? In this case, a predetermined-rates mortgage could well be a very suitable alternatives since it removes any unexpected shocks.

- What is your own exposure threshold & financial stability to keep the latest monthly construction financing payment?

- What’s the field mindset? Think about the possibility of rates of interest decreasing next 1 so you’re able to 2 years, consumers get like going for a shorter lock-from inside the period for their construction mortgage.

dos. Lock-For the Several months:

New lock-inside the several months describes a specific timeframe where you are compelled to keep up with the mortgage with the same lender otherwise deal with punishment having refinancing or early cost. When examining mortgage bundles, take note of the lock-within the months:

i. Lengthened Lock-During the Period: Fund that have lengthened lock-in episodes, generally speaking less than six age, can offer way more advantageous rates or other benefits my response. However, it restrict your liberty to change lenders otherwise re-finance through that months.

ii. Faster Lock-When you look at the Several months: Money which have shorter lock-inside attacks, including one or two many years, give higher liberty but could include a bit highest rates otherwise a lot fewer pros.